Who wouldn’t say that, and blockchain technology is gaining momentum day by day, impressing us with the field of application. With that, there is no need to do any research, everything, so, can be seen in a variety of ideas and projects that seek to realize this potential in certain areas of our lives. However, projects related to the cryptocurrency exchange market to Fiat and vice versa, still remain the majority. And all because the topic of high-quality crypto transfers is still very relevant and in demand throughout the world.

Despite the fact that the cryptocurrency market is now to make it somewhat not in the best possible light, its technological tools are still growing. Show us new solutions, existing networks, and new approaches to many standard interaction conditions.

In addition, they do not know exactly how to get this asset, where is the best to store it and more. That together leads to one big question mark, how to learn and attract active audiences in this market segment, as well as to show them the best quality of all available cryptocurrency exchanges. With such requests it began its journey, a new cryptocurrency platform called – #ASLAdex

About the project

#ASLAdex is a decentralized digital currency trading platform. Such exchanges include trading one digital money for another, buying and selling coins, and trading fiat cash into crypto. This is a little like long distance trading, where fiat monetary standards from around the world are exchanged 24 hours a day. The amount of cryptographic money has exploded in recent years and evaluations recommend that there are more than 2,000 present today. Many of these coins must be obtained using significant digital currencies, for example, Bitcoin or Ethereum. In line with this, you might need to make an exchange if you need to add initial coin contributions (ICO,), or utilize the administration of the blockchain organization.

One of the advantages of crypto exchange is that you can be included without mining coins yourself – a procedure that requires investment, vitality, special abilities, and lots of great processing power. Important to the intrigue and usefulness of Bitcoin and various other forms of digital money is the blockchain innovation, which is used to store records online from a large number of exchanges that have been led, in this way providing the information structure for these records is very safe and is shared and completed by all individual hub systems , or the PC stores duplicate records. Every new box created must be checked by each hub before being confirmed, making it practically difficult to produce a chronic exchange.

ASLA is a decentralized exchange stage based on blockchain and smart agreements. The whole stage is driven by its local token called the ASLA token. The token holder will win day to day profits from the stage turnover. An outstanding differentiator from the ASLA project is its adaptability. The stage is being arranged in such a way that it is as enticing and useful for beginners as it is for the specialists in the crypto exchange room. The stage has a multi-faceted perspective with four items. It combines, ASLAtrade, ASLAdex, ASLAgames, and ASLAmessenger.

ASLAtrade products

The ASLA platform is equipped with two amazingly basic and open crypto devices, making it the ideal open door for beginners and non-beginners. However, he also encourages the exchange function which is also related to specialist exchanges. Holding companies with exceptional agreements, ASLAtrade also offers a first-rate information guarantee.

In addition, this project also has extraordinary hazard reduction techniques. Every one of the clients needs to do when exchanging on ASLAtrade is to place a bet – high or low, and after that just sit tight for the results.

ASLAgames. Blockchain games are a hot pattern in today’s computer gaming space. The idea is fun, safe, and useful. The game stage ASLAproject ASLAgames is very easy to use. You simply join and play various games that can be accessed. When you play on the network, ASLAgames gives you valuable benefits. Before the year is over, ASLA will include games such as billiards, chess, solitaire, durak, lotto, and more.

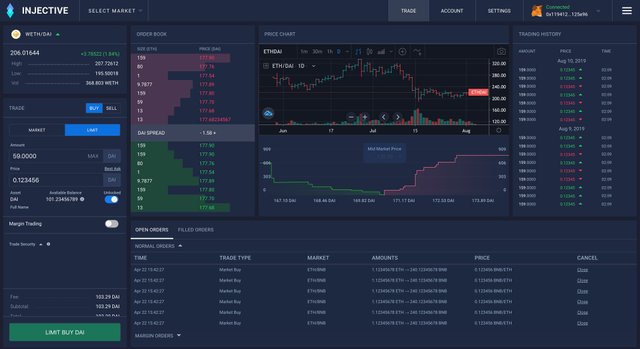

ASLAdex. is a decentralized stage of computerized money exchange that underpins ASLAtrade. Although it offers fast and top security, it generously cancels exchange procedures through an easy-to-use interface. In addition, ASLAdex is also very good for the hoarding of computerized resources.

This platform has just completed an organization with an unmistakable name in the crypto space including TRON, TRXplorer, Wist Company, and PoliniDex. Recently, it entered into an association agreement with an online store called Boxgadget. With this, clients will have the option to buy from Boxgadget using TRX and ASLA coins. Most will agree that this organization is a significant progress in directing the acceptance of standard crypto.

currently we are completing the main phases of the stage progress and will begin to expand its use.

Download and install on your mobile device

https://play.google.com/store/apps/details?id=vip.mytokenpocket

https://apps.apple.com/ru/app/tokenpocket/id1436028697

Download and introduce one of the TRON purses recommended by TronWallet or Tronlink by utilizing the connection below. Currently, portable versions of the TronLink and TronWallet wallets can be accessed, such as the work area form of the addition of TronWallet and TronLink to the Google Chrome internet browser.

It’s no secret that one of the most important conditions for a good exchange is the trading system, without which, in principle, it is impossible to implement half the standard functions. In addition, ASLA has surpassed all of its competitors and has sophisticated interface features, thanks to traders who can finally manage the trading process, as well as market volume without exceeding their physical and mental abilities.

#ASLA #ASLAgame #ASLAtrade #poloniex #cryptocurrency #tokens #binance #yobit #trading #gaming

Conclusion

Considering all of the above, in the end I just want to add one thing. The ASLA platform is a very interesting manifestation of many non-standard ideas, applications that are ready to revolutionize the entire crypto-eye space. And the qualitative revolution, improves many typical functions, and is familiar with all tools. While broadcasting a new look at an established approach.

But to be, as they say, on the same wave with extraordinary progress and ideas, you need to get acquainted with the ASLA project in more detail.

To do this, I have specifically prepared all the official and social resources needed from the project. You will find a lot of useful information, which unfortunately I didn’t even have time to mention.

For more information visit the official ASLA Exchange Sources below: