I- Injective Protocol Future of Exchange

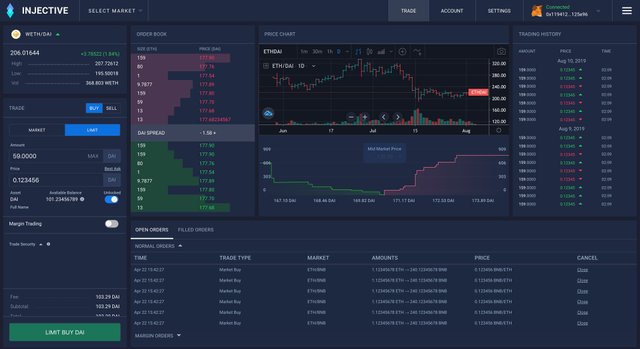

The injective protocol is a crucial "evidence" of Injective. it's an open protocol that supports the event of open derivatives markets. it's also the world's first fully decentralized P2P futures and perpetual swap contracts exchange, which supports simple access to numerous markets.

According to the team, compared with other products of the identical type, Injective is that the fastest, fully decentralized derivatives trading platform without gas fees within the Defi market.

Based on the Injective chain, Injective's trading platform has also achieved a completely open-source design, which allows it to be a totally decentralized network.

It also provides a market-maker friendly API interface, which is near the present mainstream exchange interface, allowing the user experience to be like that of a centralized exchange. Additionally, within the management.

Internet finance and the digital age

Needless to mention, the exchange medium and platform are of top importance throughout the financial history. The medium has went from shells, stones, and metals to paper and now digital numbers to our eyes. The platform has evolved from the physical markets to the electronic stock trading systems and exchanges and more. Digitalization and "internetization" are the new focuses.

within the past decade, since Satoshi Nakamoto invented Bitcoin, the exchange medium and platform have again shifted from centralization to decentralization. After the ICO hypes in 2017, the tokenization of assets has grew popular and now towards better maturity. At the identical time, various digital asset trading and exchange platforms also utilize blockchain technology to attain decentralization, hinting a promising future for internet finance and exchange as a function itself.

In this century, human civilizations have made significant progress in digitizations. In just two decades, the internet has gone through three ages: the age of the portal, the age of search/social, and the age of the internet. The continuous development of the internet has altered and revolutionized the ways that humans think, behave, and interact.

Now as "data" continues to evolve as it gets produced, stored, organized, and utilized on higher levels, we start to see a new system with new rules slowly penetrating and seizing our world, that more justice, fairness, value accruals, and distributions have been demanded by all.

Given the above, that is why we are witnessing the "decentralization" of matters taking place and being facilitated more passionately than ever by the general populace.

ow as things and people get connected and integrated into an "unseen network," the characteristics of blockchain decentralization or however you call it, have become extremely incentivizing for people to act and innovate upon.

Specifically, works have been done on all layers of the internet from, again, data productions, storage, to applications (dApps), and of course along with all the innovations come with innovative business models and even "token economies."

Among the diverse applications of blockchain technologies, Defi, or decentralized finance has been one of the most hyped recently given the room of imagination and schemes like liquidity mining.

Traditionally even though we did see the boom of internet finance in the past years ranging from payments, crowdfunding, neo-banks, P2P lending and more, however, non has provided the current anticipation of "evolution" but instead just "iteration," as they did not change the rules and systems.

ow as things and people get connected and integrated into an "unseen network," the characteristics of blockchain decentralization or however you call it, have become extremely incentivizing for people to act and innovate upon.

Specifically, works have been done on all layers of the internet from, again, data productions, storage, to applications (dApps), and of course along with all the innovations come with innovative business models and even "token economies."

Among the diverse applications of blockchain technologies, Defi, or decentralized finance has been one of the most hyped recently given the room of imagination and schemes like liquidity mining.

Traditionally even though we did see the boom of internet finance in the past years ranging from payments, crowdfunding, neo-banks, P2P lending and more, however, non has provided the current anticipation of "evolution" but instead just "iteration," as they did not change the rules and systems.

development and current status of traditional exchanges.

An exchange is a trading platform with diverse products, which provides price discovery and liquidity for traded products. Technological advancements have facilitated and effected also the business model and infrastructure of the exchanges.

Not many people stand in offline market places and shout out the prices of their goods to attract buyers nowadays, but try to get their goods sold through electronic trading systems. In terms of the business model, most exchanges in Europe and the United States have gone from membership-based to form for-profit companies.

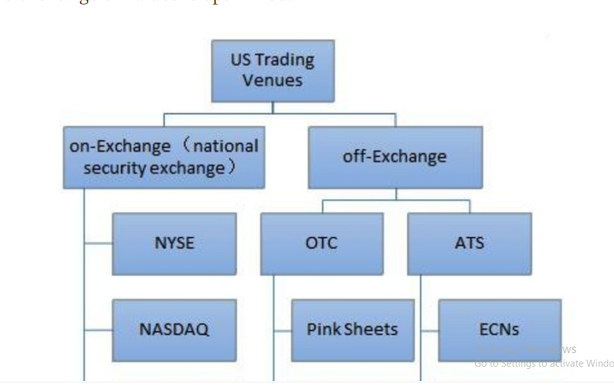

As the hub of financial activities, the development of exchanges is heavily affected by regulatory policies. However, as technology develops, regulations loosen, and business competitions carry on, Alternative Trading System has emerged since 1990 in the US Multilateral Trading Facility, adding flexibility and diversity to the financial world.

progress of exchanges based on blockchain technology.

With the application of blockchain technology in asset tokenization and the trading of it, many digital asset exchanges have emerged, such as Binance, Coinbase, Bitmex, etc. These well-known exchanges are also classified as centralized exchanges in the blockchain and digital asset industry.

Centralized exchanges, as the name suggests, means that the assets deposited by the users are stored in the hands of the exchange owners, and matching of trades and even prices of products are subject to centralized controls operated on centralized servers. In other words, we, as users, do everything on the platform based on our trust in the team and institution running it.

In comparison, the essence of decentralized exchanges is to allow users assets to be under decentralized custody, with every transaction record stored on the blockchain giving transparency and traceability. Simply put, this whole decentralization is meant to prevent malicious human behaviors and to facilitate users to trust in codes and technology instead of other human beings. Let's probe further in details.

Decentralized Exchange utility works.

With the advancement of blockchain technology and the emergence of more public blockchains, there are now a variety of decentralized exchanges. DEXes are different because of the diverse public blockchains they are based on and their respective concepts and technologies. Here we only discuss the decentralized exchanges about the general traits.

One of the key aspects of decentralized exchanges is that the exchange accounts equate to smart contract accounts. In brief, storing assets on DEX is to store them in smart contracts which is to store them in codes, and in codes you trust.

Generally, most DEXes will only ask for registration some even require KYC, and it has been criticized for a platform to call itself a DEX whilst asking for KYC and to deposit, withdraw, and trade:

Deposit

you deposit by transferring your assets into the smart contract address assigned to you by the platform.

Withdraw

withdraw from anywhere directly from the smart contract address.

Trading

your asset is transferred from the smart contract address directly to that of your counterparty. This transfer can be checked on the blockchain through the blockchain browser, and the entire transfer process relies on the smart contract's automatic execution by codes.

DEXes can be further divided into two focuses: spot and derivative markets. Most of the DEXes in existence focuses on the spot markets, and are not many derivatives DEXes given the complexity of financial designs development workloads.

However it has become palpably clear that derivatives markets have grown exponentially in the digital asset domain, and we are already seeing the next

boom coming from derivatives trading. Few strong contenders that have emerged in 2020 include Injective Protocol, DerivaDEX, and Serum. Here let's explore Injective Protocol, which will be launched in August.

To resolve common issues faced by DEXes such as user-friendliness, speed, and more, the Injective Protocol proposes a global solution: Injective chain, Injective derivatives protocol, and Injective DEX.

II- Partner of Injective Protocol

1. Injective Protocol Announces Strategic Partnership with WOOTRADE

Injective Protocol is officially announcing this strategic cooperation with the dark pool, WOOTRADE. Through cooperation in the implementation of liquidity management, the design of crypto asset derivative products and markets, and international corporate brand development, both sides will work together to create a breakthrough in the DEX space by growing user acquisition.

WOOTRADE was incubated by Kronos Research, a leading quantitative investment research institution, and is funded by distributed capital from DFund, SNZ, Hashkey, as well as vector capital investment. The dark pool has a team with extensive experience in trading crypto assets and secondary assets. The top institutional trader has the technical expertise to manage high-level crypto market derivative products. Injective Protocol’s derivatives protocol and technology-driven ecology can provide institutional traders, such as Kronos Research, with the ideal environment and conditions for the swiftest, most fair and safe service of markets and products.

Injective Protocol is a decentralized peer-to-peer protocol that aims to enable fast and secure perpetual swaps, futures, leverage and spot transactions on Ethereum. To facilitate this, WOOTRADE will provide a transaction depth of 100 BTC with a spread of 0.05%. This liquidity stems from the in-depth aggregation of major exchanges, and the support of quantitative investment research institution Kronos Research for market-making strategies. Kronos has a daily transaction volume of $1 billion. In order to provide sufficient liquidity, WOOTRADE will also provide a low rate of 0% for connected exchanges, which saves hedge costs for exchanges. All in all, this collaborative effort will lead to a paradigm shift in the DeFi world.

2.Injective Protocol Announces a Strategic Partnership with Krypital Group

We are pleased to officially announce Krypital Group as a strategic partner of Injective Protocol!

As one of our early-stage strategic investors, we are deeply grateful to Krypital Group for their multi-dimensional support for the development of our project. Krypital Group will deliver a series of tailor-made global marketing campaigns, which aim to solidify the global reputation of Injective Protocol as well as maximizing the impacts of all upcoming operational and marketing strategies.

Through this strategic alliance, we will continue to unveil plans for events, promotions and other marketing plans in the future. We are excited to share more updates with our community as we make our way to bring our dream of fully decentralized derivatives DEX to you.

Krypital Group is a leading global blockchain incubator and venture capital. Focused on venture funding, one-stop consulting and brand management services, Krypital Group supports dedicated projects with great potentials.

To know more about the Krypital Group, please visit their official website here: http://krypital.com/

Injective Protocol, a decentralized derivatives exchange protocol incubated by Binance Labs, has raised $2.6 million in a seed funding round.

- Led by Pantera Capital, the round also saw Asia-based QCP Soteria, Axia8 Ventures and Boxone Ventures, Bitlink Capital and others participate, Injective announced Wednesday.

- Injective Protocol sets out to resolve scalability issues and bottlenecks that can mar the user experience on decentralized exchanges (DEXs).

- The project was one of eight inducted into the Binance Labs Incubation Program in 2018, with the mission to resolve some of the shortcomings DEXs face, such as high latency and poor liquidity.

- Aside from the seed investment, the group of investors will also provide liquidity solutions for Injective and support its business developments and global brand recognition, according to the press release.

- Pantera Capital partner Paul Veradittakit said the investment firm led the round because of its belief that Injective is a “strong contender†for expanding decentralized finance (DeFi) beyond Ethereum’s platform.

- The funding comes as the protocol prepares for a mainnet launch and a new token to be issued in the latter half of 2020.

- Official Website: https://injectiveprotocol.com

- Whitepaper Link: https://docsend.com/view/zdj4n2d

- Github: https://github.com/InjectiveLabs

- Reddit: https://www.reddit.com/r/injective/

- Twitter: https://www.twitter.com/@InjectiveLabs

- Telegram: https://t.me/joininjective

- Linkedin: https://www.linkedin.com/company/injective-protocol/

Không có nhận xét nào:

Đăng nhận xét

Cảm ơn bạn đã nhận xét