Introduction to Euclideum

Two years after Vitalik Buterin announced the Serenity project at Devcon in 2018, Ethereum 2.0 remains a project, not a reality. The launch of the new, scalable Proof-of-Stake network has been delayed many times. Numerous testnets - Schlesi, Witti, Atona and now Medalla - are all steps in the right direction, but the goal remains distant. The launch of Phase 0 is now scheduled for December 2020 or January 2021, but it's likely to get delayed once again.

Meanwhile, the pressure on the Ethereum network keeps mounting and we are seeing more and more lags and freezes and increases in fees. From just $0.05 per transaction, the miners fee has grown to $1.5. Ethereum isn't the fast and near-free means of payment that it once claimed to be.

The Euclideum project is a result of the efforts of a group of developers to solve these problems as fast as possible. Waiting for another year or two or more for a more scalable version of Ethereum isn't a practicable solution.

Euclideum is a version of the Ethereum blockchain that features Proof-of-Stake consensus and delegated staking. The name of the cryptocurrency itself is Euclid. Launching a node will require a smaller stake than in Ethereum (30 ECL vs 32 ETH). Users who don't want to bother with a node will be able to delegate their ECL coins to one of their choice and receive a share in the rewards, like with Cosmos or Tezos.

At launch, the expected processing capacity of the Euclideum blockchain is circa lOOtps, with an average block time of 10 seconds. Already at this stage, transactions will take 2-3 times less time to process than on Ethereum.

Euclideum will also introduce sharding on a testnet soon after launch, with 4 initial shards. Splitting the blockchain into substates is a good scaling solution, and it can potentially increase the capacity to 10,000 tps or more. However, a testing period is required before sharding is rolled out on the mainnet.

Euclideum also has its own liquidity protocol, Ptolemy, and a decentralized exchange (DEX) under the name of ArchimeDEX. The exchange will support ECL, ETH, ETC, ERC20 assets, and all the assets created on the Euclideum blockchain. ArchimeDEX will feature direct asset swaps to minimize fees and adjustable fees to ensure that all transactions go through.

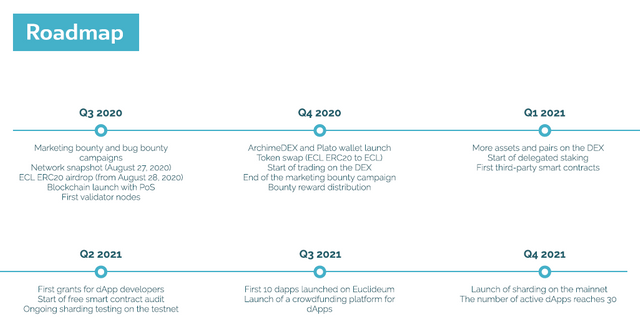

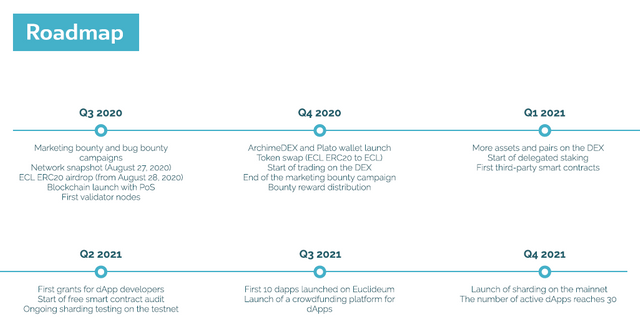

Euclideum coins will be distributed in a large scale airdrop after a snapshot of the Ethereum network, scheduled for August 27, 2020. Every ETH holder is entitled to 3 free ECL coins for each 1 ETH they store in their wallet. The snapshot will show how many ECL every user should be airdropped. Holders don't need to give up their ETH to get ECL, though: the distribution is completely free.

At first ECL will be distributed as an ERC20 token. When the blockchain is launched, ECL holders will be able to swap

Apart from the airdrop, users will have several ways to obtain free ECL coins. They can participate in the marketing bounty campaign, bug bounty, referral program, or a voluntary KYC.

Euclideum can be used for creating decentralized applications (dApps) and smart contracts, just like Ethereum. Developers who build dApps for Euclideum will receive special grants. Moreover, any smart contract deployed on the blockchain will be entitled to a free audit.

The rest of this White Paper deals first with individual features and innovations of Euclideum and then with the Euclid cryptocurrency, its emission and distribution.

/Euclideum The blockchain, protocols, and features

***PoS: fast and cheap transactions

Specific issues to be solved:

network lags and freezes, high fees, pending transactions, blocks without rewards.

Ethereum's scaling problems became particularly evident in June and July 2020, when the network experienced widespread congestion and lags, with a record rise in transaction fees. The reason was extreme congestion of the Ethereum mempool, with more than 100,000 pending transactions.

The main 'gas-guzzlers' - projects that account for most network activity - are stablecoins like USDT (Tether) and USDC (USD Coin). Their market capitalization spiked as a result of the coronavirus pandemic, because they are seen as a safe investment.

On June 6 and 7, the total amount of fees paid by ETH users was almost twice higher than the cumulative fees in the Bitcoin network. The average transaction fee jumped to $1.5.

Historically, the way to manage congestion has been to increase the gas limit per block. This allows miners to process more transactions every second. In September 2019, the limit was raised to 10,000,000 gas, but by June 2020 it was clearly not enough. In late June, Ethereum miners voted to raise the limit to 12,500,000 gas. This increased the capacity from 35 tps to 44 tps, and the average fee went down for a while. However, just a month later, the network was at its limit again.

Increasing the gas limit is only a temporary solution, and the only problem it solves is the high transaction fee. But it can't be a long-term option - in fact, it creates new issues of its own. Blocks become bigger and take longer to mine. As a result, there are now many more 'uncle' or orphan blocks that eventually aren't added to the chain and don't receive a reward. Moreover, nodes can get overloaded and some nodes with a lower processing capacity might even be forced to stop mining altogether.

The only real solution to the problem is Proof-of-Stake, but Ethereum won't be able to switch from PoW to PoS in the next 6 months at least, as we've already noted. Meanwhile, fees will keep getting higher and the network will keep lagging.

The team of Euclideum made the decision to launch the network as a PoS blockchain from the start in order to demonstrate that it does work - and that it doesn't require years to test and launch. The expected processing capacity at launch is circa 100 tps, which is more than twice than Ethereum's present speed.

*** ECL staking

Specific issues to be solved:

Constant delays in the transition to Ethereum 2.0 and PoS staking; high entry barrier; irreversibility of staking; lack of delegation possibility.

Euclideum is a Proof-of-Stake network from the start. In 2019 and 2020, the team has modified and tested all the major PoS models proposed by Ethereum developers. Thanks to this, there is no need for a lengthy transition period from PoW to PoS, as it is happening with Ethereum.

At launch, Euclideum will already have several validator nodes run by the team. Users can immediately start staking and start their own nodes. To become a validator, one needs only 30 ECL as opposed to 32 ETH on Ethereum. The expected annual profit from staking is 8-10%, with the initial yield being 6.5% (as opposed to 5.6% on Ethereum).

Reversible staking ^■

Another important difference between staking on Ethereum and Euclideum is that ECL validators will be to withdraw their stakes as early as 3 months after the network release. In Ethereum, the staking transaction will be irreversible until the launch of Phase 2.

Since nobody knows how long it will take for Phase 2 to be ready, validators essentially commit their ETH to staking indefinitely. This means they will miss out on any potential speculative profits if the price of ETH rises sharply in the meantime.

In Euclideum validators will be able to withdraw the staked ECL without any penalty and without losing the accumulated rewards. This is in line with all other staking coins, such as Tezos and Cosmos. This way, when the price of ECL starts to go up, one can release the staked coins and sell them to maximize the overall profit.

Delegated (passive) staking

Ethereum 2.0 will allow only active staking - that is, the user has to run a validator node to earn rewards. However, one needs good technical experience and understanding of the technology to manage a node. Most probably, a lot of investment platforms will also arise to allow people to stake passively. But they will all be custodial and trusted by default, because one can't algorithmically delegate ETH to a node the way one does it with Cosmos, for example. Exchanges like Binance will probably start their staking services, but they won't be transparent, and opportunities for fraud will be rife.

Euclideum already includes the possibility to delegate ECL to a node and earn passive rewards. This possibility will not be activated in the original release, but rather 6 months after launch. But that time, there should be enough user-run nodes in addition to the original set of nodes managed by the founding team.

Nodes will be able to set the desired fee - the share of the reward they will keep for themselves. We expect that passive delegators will earn a default rate of 4.5%-8% a year, which is on par with the rate paid by Tezos and other major PoS coins.

For nodes, delegated staking is an advantage, because it increases their stake and their chances to get selected to validate a block. A node that manages to attract more delegators will earn more on average. Thus, delegation will create additional incentives for users to start new nodes.

Slashing

Validators can be fined for acting against the interests of the network. This is done through cutting (slashing) their stake. The most common example is being offline for more than 50% of the time in 24 hours. The slashing penalty in this case is very small, and only the validator is affected: the delegators who stake on the same node won't lose anything.

However, validators can lose much more (from 1 ECL to the whole stake) if they act maliciously. In this case, their delegators will also be slashed, though by a smaller amount. The idea is that delegators should exercise caution when choosing a node to stake on.

/ Ways to earn free ECL

Marketing bounty campaign

Users can earn free euclids for helping to promote the project both before and after launch. Different bounty rewards will be paid for various types of assignments:

Social media: posting tweets and Facebook messages or reposting those published in the official accounts of the project;

Articles and reviews: informative content published in blogs, on news websites, review platforms etc.;

Video reviews on YouTube;

Forums: posting messages about the project and wearing a

Euclideum signature.

The most active users, or those who produce top-quality content, can earn significant amounts of ECL - enough to delegate the coins to a validator node and receive staking rewards, for example.

Bug bounty

This campaign is directed at developers: the idea is to find vulnerabilities in the source code and smart contracts of Euclideum, including the DEX and wallet. The prizes are much higher than in the marketing campaign (up to 10 ECL per bug). To participate, submit a request through the Euclidium website to receive further instructions.

Voluntary KYC

The KYC is very basic and completely voluntary. It doesn't affect users' ability to access the platform and its features. In the future, users who have passed the KYC may be offered advanced services that aren't available other users for compliance reasons, such as investments in tokenized stocks and commodities on the DEX.

Every user who passes the KYC will receive 10 ECL as a reward. These 10 ECL can be allocated towards delegated staking to generate rewards.

Referral program

As mentioned before, every ETH address is entitled to free ECL coins. However, one needs to claim them through the ArchimeDEX exchange and Plato wallet. The goal of the referral campaign is to reach more ether holders and make them aware of the airdrop.

When a user claims their ECL, they will receive a personal referral link to send to other people they know who have ETH accounts. If some of them also claim free airdrop euclids, the referrer will receive a bonus: 5% of all ECL claimed. By inviting several people, it's quite possible to accumulate 5 ECL or more in referral rewards, which can be used towards delegated staking or as part of the 30 ECL stake necessary to launch a new validator node.

Website & Media

Contact euclideum

contact@euclideum.com

author:

Bitcointalk usename: katakuripham

Không có nhận xét nào:

Đăng nhận xét

Cảm ơn bạn đã nhận xét