The spate of boom of decentralized finance (DeFi) has been overwhelming in recent times, with new DeFi projects springing up in the space. The sentiment around DeFi has become a honeypot attracting a large number of new investors and developers.

New DeFi startups strive to recreate existing legacy financial system in a way that unleashes the potential trapped in decentralized finance through the creation of various instruments that mirror or track different traditional financial assets without leaving the decentralized crypto environment. These innovations could be decentralized exchanges (DEX such as Uniswap), lending, borrowing, staking, synthetic assets and others. Many DeFi applications enable users to earn new tokens through yield farming and liquidity mining. The energy and excitement are rapidly rising.

However, recent events are showing the dark side of some DeFi products, especially with the yield earnings promised by many DeFi applications newly launched in the market.

The Problem

The terrific growth of DeFi in recent times is apparently driven yield farming and liquidity mining concepts. However, it has also attracted a lot of people or yield farmers driven solely by profits and greed. This narrow view of DeFi has resulted in many DeFi projects having a very short life cycle as people jump from one project to another in search of quick gains.

Liquidity miners can easily pull out liquidity from one project and move it out into another one or simply cash out. This sort of approach to DeFi investment is not sustainable as many projects may fizzle out or be unable to attain their full potential.

In a bid to solve this problem, a new top-tier DeFi project, DEGO, has come up with feasible solutions that will ensure sustainability of DeFi innovations.

What is DEGO?

DEGO is a DeFi protocol that aims to extend the decentralization, longevity and sustainability of DeFi applications via adjustable liquidity mining. With DEGO, the dark sides of DeFi posed by unsustainable yield farming and liquidity mining are solved with more focus on the long-term preservation of various DeFi products. DEGO aims to protect the entire DeFi ecosystem, including investors and decentralized finance instruments available in the market.

There are so many gems hidden in the DeFi ecosystem but investors can only harness few due to limited financial resources available at their disposal. DEGO leverages DeFi protocols in a smart and sustainable way to ensure that users benefit from diversified DeFi investment portfolio in staking and liquidity mining offerings.

Just like a LEGO, DEGO combines and integrates any DeFi Protocol. Whether it is a stablecoin, decentralized exchange (DEX), lending and borrowing, derivatives, or decentralized insurance, DEGO further extends the value around these protocols, where each can seamlessly fit in as building block. DEGO is the perfect decentralized application (dApp) to help users harness various DeFi products without limitation while maximizing financial returns.

How DEGO works

Many DeFi projects are at the risk of ending prematurely as whale farmers jump from one DeFi ship to another. DEGO has designed a protocol that addresses this unsustainable practice. In a bid to resolve this issue, DEGO has developed a liquidity mining with the algorithm adjusted to ensure sustainability.

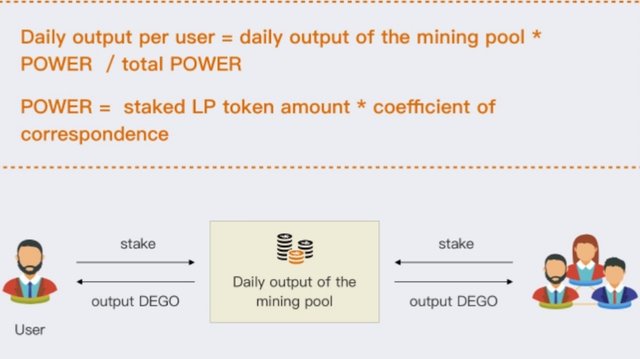

DEGO utilizes a set of deterministic algorithms to generate and distribute rewards for liquidity mining, to convert the liquidity provider (LP) token staked by users into POWER, and to generate rewards via the staked tokens (where power is the product of the staked LP token amount and the coefficient of correspondence). This means that tokens in the pool are shared based on an algorithmically determined model. Through this means, DEGO will be able to create a better and more sustainable DeFi ecosystem of liquidity mining for all users.

The image below shows more information about this.

DEGO Token

DEGO is wholly a governance token designed for voting in DEGO DAO governance. DEGO provides equal access and opportunity to all token holders to partake in DEGO ecosystem. As a DAO, DEGO is carefully created to be community-driven in order to ensure its full decentralization and transparency of operations. Therefore, the community holds decision-making power and will be able to vote on proposals.

DEGO Token Information

Token supply: 21,000,000 DEGO

Presale supply: 10% of total supply ( 2,100,000 DEGO)

Uniswap Liquidity: 5.25% of total supply (1,102,500 DEGO)

Mining rewards: 80% of total supply (16,800,000 DEGO)

DEGO DAO:. 3.75% of total supply (787,500 DEGO)

Airdrop: 1% of total supply ( 210,000 DEGO)

Conclusion

Overall, DeFi products are trustless, permissionless, and open access to everyone regardless of financial status, age, or geographic location. DEGO gives everyone the freedom to access benefits of open finance through sustainable liquidity mining mechanism. DEGO, unlike many unaudited experimental DeFi DAO projects, has completed its security audit, further demonstrating its legitimacy, transparent, security focus on DeFi sustainability.

Looking for a sustainable DeFi project to farm, DEGO is the right choice.

Useful Links

Click on the following links to get more information about DEGO:

Website: https://dego.finance/home

Twitter: https://twitter.com/Dego_Fi

Telegram: https://t.me/dego_finance

Discord: https://discord.com/invite/xJjSJrd

Github: https://github.com/dego-labs

Author: Arkadiy9

BTC URL: https://bitcointalk.org/index.php?action=profile;u=2723852

Không có nhận xét nào:

Đăng nhận xét

Cảm ơn bạn đã nhận xét