eCoinomic.net VS Nexo

Which is better?

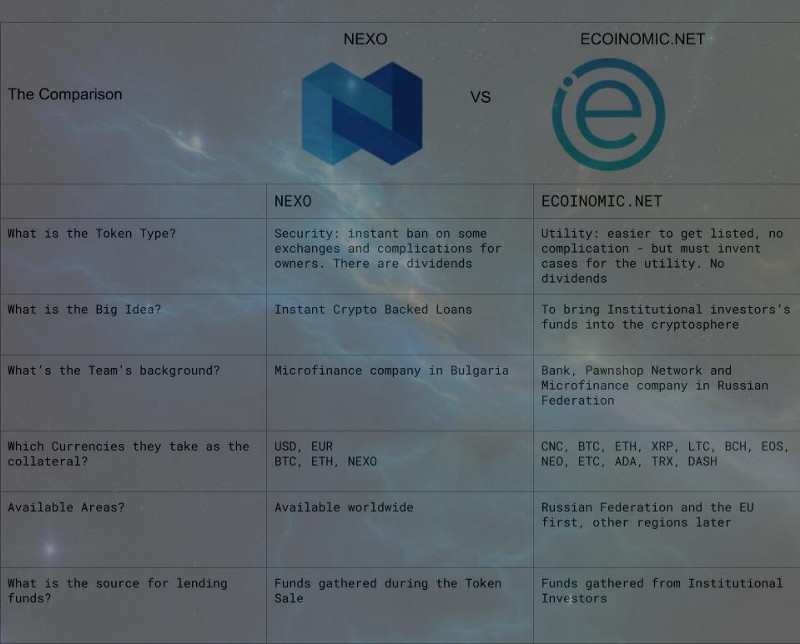

My small comparison of two biggest projects on the crypto-backed loans:

Which is better?

My small comparison of two biggest projects on the crypto-backed loans:

Nexo and eCoinomic.net

Personally, I would prefer eCoinomic.net — they have more experience in finance and more realistic source of funds

What eCoinomic (CNC)????

Beginning from 2001, different individuals working in the field of monetary start-up and advanced innovation effectively joined together and make a group that cooperates. These individuals are creators and designers of the eCoinomic venture. The objectives and procedures of arranging have been made by the group and effectively accomplished effectively. eCoinomic itself is a piece of the Sauber Group, an organization occupied with the money related administrations and fintech industry.

Sauber Bank is a JSC write organization (Joint Stock Company). Initiated in 1992, Sauber Bank was built up with values alluding to the USSR (Union of Soviet Socialist Republics). The foundation of this association is additionally done based on change or remaking of the previous bank. Administrations performed by Sauber Bank incorporate advances, cash stockpiling, cash changes, and stores.

Microfinance organization under the name Dengi Budut will likewise be a vital scourge that assumes a part of eCoinomic venture arranging. Dengi Budut is a Russian organization that began its business in 2011. Occupied with credit, until 2018 Dengi Budut improvement accomplished great outcomes. Building up its business wings in different urban communities in Russia, Dengi Budut is currently one of the spearheading organizations in advances and credit in the nation.

Another organization that is supporting the eCoinomic venture is the Leningradsky Pawn Shop Network. As another organization that stands 2 years, the development capability of their business can be said quickly. Moving in items, for example, gold and different other gems, the organization gives advances and different administrations, whereby gems and gold are the principles focus in exchange talks. Until 2017, Leningradsky has accomplished their ROI of up to 23%.

The last organization featured is SIIS. Moving in the field of data and correspondence, SIIS was shaped in 2009. The SIIS group comprises of different individuals who have practical experience in the realm of work, particularly the focal point of the organization benefit field. Each subject of their group is an accomplished site master, software engineers, and executive. The administrations of SIIS give brings about information preparing and web investigation.

What does the company eCoinomic?

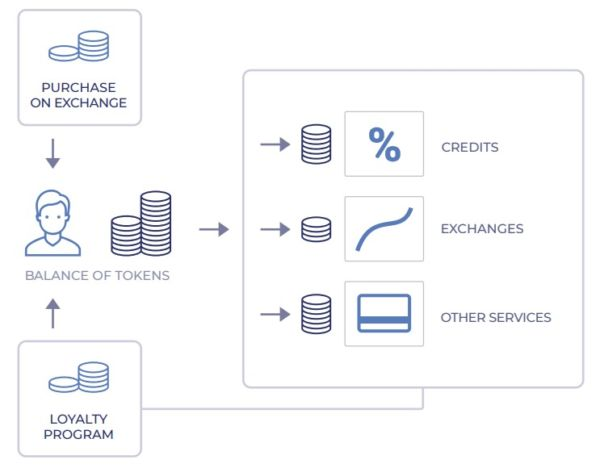

eCoinomic is a financial services platform based on crypto-currency assets. It provides its users with the functions of lending, exchange, transfer, financial management and integration with online payment services and systems.

eCoinomic is a financial services platform based on crypto-currency assets. It provides its users with the functions of lending, exchange, transfer, financial management and integration with online payment services and systems.

This is a completely new project, which aims to provide comprehensive financial solutions for investors in the world of crypto-currencies. The platform intends to do this through investment and asset management, exchange, transfer and mutual settlements between stakeholders in the cryptographic sphere. This platform is even for its users, and each member has unlimited access to many of their excessively advantageous services. These include:

Both secured and unsecured loans based on money, as well as virtual currencies

Long-term and short-term investments in the net and digital currencies

Strategies for hedging volatile cryptoactive assets

Fiscal operations, exchange and management of collateral assets

Purchase products and services using crypto conversions in large electronic markets, such as eBay and Amazon.

Fiat and virtual maps supported by cryptoactive assets.

Long-term and short-term investments in the net and digital currencies

Strategies for hedging volatile cryptoactive assets

Fiscal operations, exchange and management of collateral assets

Purchase products and services using crypto conversions in large electronic markets, such as eBay and Amazon.

Fiat and virtual maps supported by cryptoactive assets.

The ICO

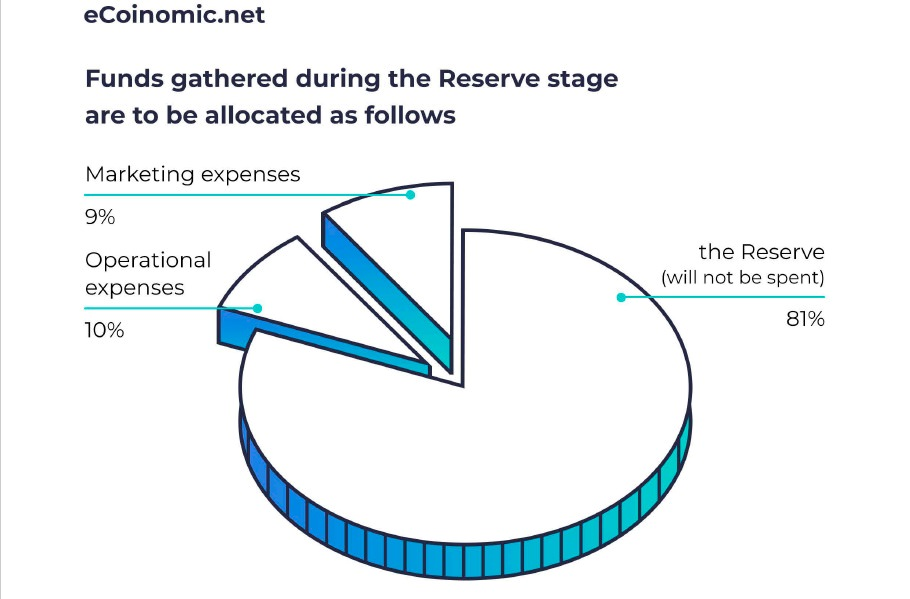

In ICO (Initial Coin Offering) eCoinomic, the token supply stage will be separated into two pre-deal stages and group deal stages. In ICO discharged by eCoinomic, the dispersion of assets acquired through financing will be done uniquely in contrast to other ICO fintech organizations. eCoinomic states that the assets they win through the offer of tokens won’t be utilized completely.

In ICO (Initial Coin Offering) eCoinomic, the token supply stage will be separated into two pre-deal stages and group deal stages. In ICO discharged by eCoinomic, the dispersion of assets acquired through financing will be done uniquely in contrast to other ICO fintech organizations. eCoinomic states that the assets they win through the offer of tokens won’t be utilized completely.

eCoinomic isolates the distribution of assets they make as future arranging. Of the assets got through ICO, 81% of the assets gathered through the token deal hold stage will be saved for the Reserve just and not for different purposes. A sum of 10% will be designated for eCoinomic operational consumption amid the advancement of their stage. In the meantime, 9% of the assets gathered will be given to oversee limited time and promoting assignments.

The reason for the Reserve is clarified as a certification for the manageability of the early trip of the eCoinomic stage. Assets gathered and designated to the Reserve will be utilized as a sureness of getting stores from the money related organizations for a specific sum. Through these assets, the operational exercises of the eCoinomic stage that will at first give an administration framework as credits can be made. Having a substantial distribution, it is sure that borrowers who endow eCoinomic administrations will likewise come in extensive numbers.

The ICO plan from eCoinomic has been resolved from the beginning of their whitepaper discharge. The pre-deal enrollment stages begin from March 15, 2018, to April 03, 2018. While pre-deal deals are directed on April 3, 2018 until 21 April 2018. In the interim, for the crowdsale arrange there is no enrollment to be performed. Offer at crowdsale stage will be hung on 01 May 2018 until 01 June 2018.

As to token offered, eCoinomic clarifies that the token that applies in their framework is principally a CNC token (eCoinomic token name). Kinds of tokens joined in the Ethereum biological system, are ERC-20. The eventual fate of this token will be the utilization of stage administrations. The business focus of eCoinomic is 100,000,000 dollars as hardcap, and 6,000,000 as softcap.

Distribution of funds:

56% – marketing costs, launch of the alpha version;

56% – marketing costs, launch of the alpha version;

22% – research and development for the platform;

22% – legal and organizational costs.

Distribution of funds collected during the main ICO:

37% – of the funds will be operating and insurance funds;

12% – development;

9% – marketing;

2% – technical security audit;

2% – legal support;

1% – operating expenses.

Roadmap

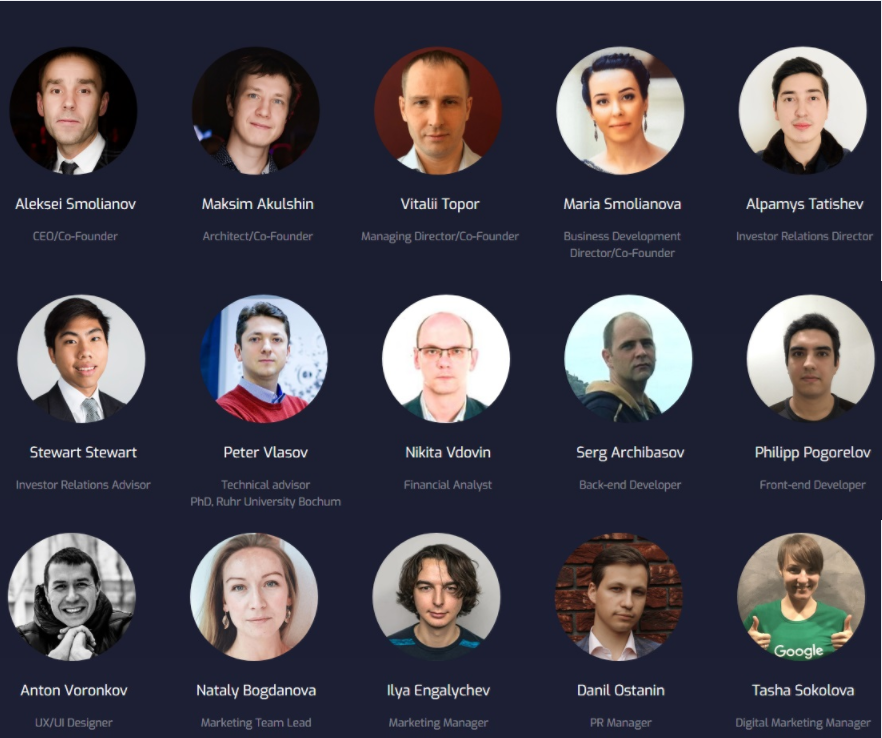

Team

Website: https://ecoinomic.net/

Whitepaper: https://ecoinomic.net/docs/eCoinomic_WP_0219.pdf

Telegram: https://telegram.me/eCoinomicchannel

Facebook: https://www.facebook.com/ecoinomic/

Twitter: https://twitter.com/Ecoinomicnet

Author: anhhvktqsk43@gmail.com

Không có nhận xét nào:

Đăng nhận xét

Cảm ơn bạn đã nhận xét