Injective Protocol is a decentralized, layer 2 exchange that is poised to solve problems peculiar to existing decentralized exchanges – A front-running resistant exchange protocol that ensures fast, secure, and decentralized trading experience.

In brief

The injective protocol is an Ethereum based decentralized finance and trading protocol that supports margin trading, derivatives, and futures.

Existing decentralized exchanges are faced with problems such as liquidity, complex user interface, and are somehow centralized in a way.

The injective protocol is being developed to solve the liquidity and high latency decentralized exchanges.

Centralized exchanges have been monopolizing the exchange market for quite along. Even though having a greater share of the market, they turn to not pay heed to some of the challenges and misfortunes suffered by some of their fellows. A critical issue is Security, the architecture of centralized exchanges makes them prone to attack which most often results in loss of funds and trust at the side of the customers.

Decentralization advocates in the crypto space have always criticized centralized exchanges for their approach, however, we seem to use them more often. This is as a result of we not have a competent fully decentralized exchange to compete with the centralized exchanges.

Ethereum creator, Vitalik Buterin in an interview with TechCrunch journalist Jon Evans, express his view on how centralized are extorting money from its customers. Vitalik said:

“I definitely personally hope centralized exchanges burn in hell as much as possible.”

Let’s take a closer look at Injective protocol and how they want to disrupt the cryptocurrency exchange industry.

What is Injective Protocol?

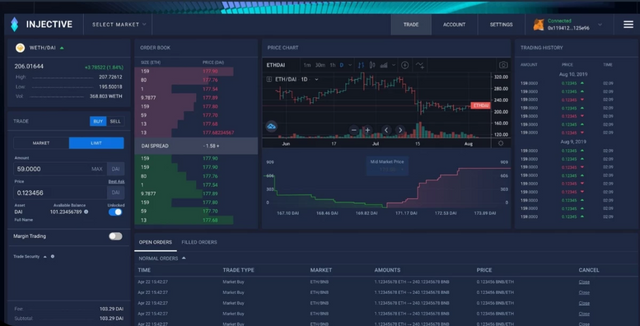

The aforementioned bottlenecks which are hindering the progress of DEX are being addressed comprehensively by Injective protocol's proposed solution which comprises the Injective Chain - a layer-2 sidechain and Cosmos zone that is connected to Ethereum blockchain, the Injective Exchange, and the Injective Futures platform.

According to Injective protocol, it is the first-ever front-running resistant, layer-2 exchange protocol that unlocks the full potential of borderless finance. It takes digital assets trading to another level while it ensures security and liquidity.

Who Founded Injective protocol?

Injective Protocol was founded by Eric Chen who is currently the CEO and his colleague Albert Chon who is also the Chief Technical Officer (CTO). Both Eric and Albert attended NYU and Stanford respectively. They collectively have several years of experience in blockchain and cryptography and this is exactly what brought them together to pursue the Injective Protocol Project. It was as a result of the Research they realized verifiable delay functions (VDFs) had the potential to solve scalability and security flaws of decentralized exchanges.

What Makes Injective Protocol One In a Million?

The injective protocol is characterized by its fully decentralized nature, from the architecture, network to governance. It offers users the means to trade whiles they have full control of their funds and could very their order posted and matched on the sidechain in real-time.

In order to secure trades of users against front-running, Injective Protocol employs Verifiable Delay Functions (VDFs) and selective delay mechanisms to provide users holistic trading and DeFi experience.

We all can attest to the fact that trading on DEXs can sometimes be troublesome. They are most often complex to use and most especially for newbies. In order to drive crypto adoption building, user-friendly products are crucial. In response to this, the DEX protocol comes with an intuitive and Human-Computer Interaction (HCI)-focused interface to encourage diverse users to use the DEX to its full potential.

What can you do with Injective Protocol

With Injection Protocol's solution, one can trade cryptos in a secured environment and with good liquidity to make entry and exiting of trades much fluid. In addition, traders can short or long cryptocurrencies with leverage in a more decentralized way unlike that of the centralized exchanges, get access to a wide range of DeFi platforms, etc. Trader will also have access to decentralized futures and derivatives markets.

Upholding the principles of decentralization, all the necessary resources required to kick start a decentralized exchange has been open source and free making it easier for new entrants into the exchange business.

Exchange providers can leverage Injective protocol's model and incentives to improve customer experience and drive revenue up.

Final thought

Injective Protocol will launch its main net in quarter three of 2020. And solving the greatest issues of decentralized exchange makes it worthwhile.

I personally would love to trade on a DEX with much improvement than what we currently have as I'm more concerned with security and decentralized.

Injective has taken a bold step and as advocates for decentralization, it's high time we push the agenda for the betterment of our ecosystem.

Community Stats

Telegram: >5000 members

Twitter: >3800 Followers

Reddit: 44 members

Github: 19 Repositories

Useful Links

Resources

Usename bitcointalk: lethingocthuy686868

MEW: 0xc19A0C710c1f57b930C82350d5A200a1C48f62de